Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, April 10.

There are no changes recommended for any of our Portfolios.

After hitting 22 all-time highs in the first quarter, the S&P 500 index hasn’t hit a new high in … seven trading sessions. Heaven forbid!

It’s just amazing how the pundits looking for their 15 minutes of media stardom can find reasons to talk the markets down (or up). Normally rational and staid characters, like J.P. Morgan’s CEO Jamie Dimon, jump in with predictions on interest rates and make front-page news—never mind that his last big prediction of recession fell flatter than a pancake.

Remember, investment markets go up and down every day they are open for trading. Hitting a record, like the S&P has done 22 times so far this year, means that on the next day, the index can either hit another record or fall below it. It’s the reality of investing. And being 1% to 2% below a record high is certainly NOT cause for concern.

Inflation Ticks Higher

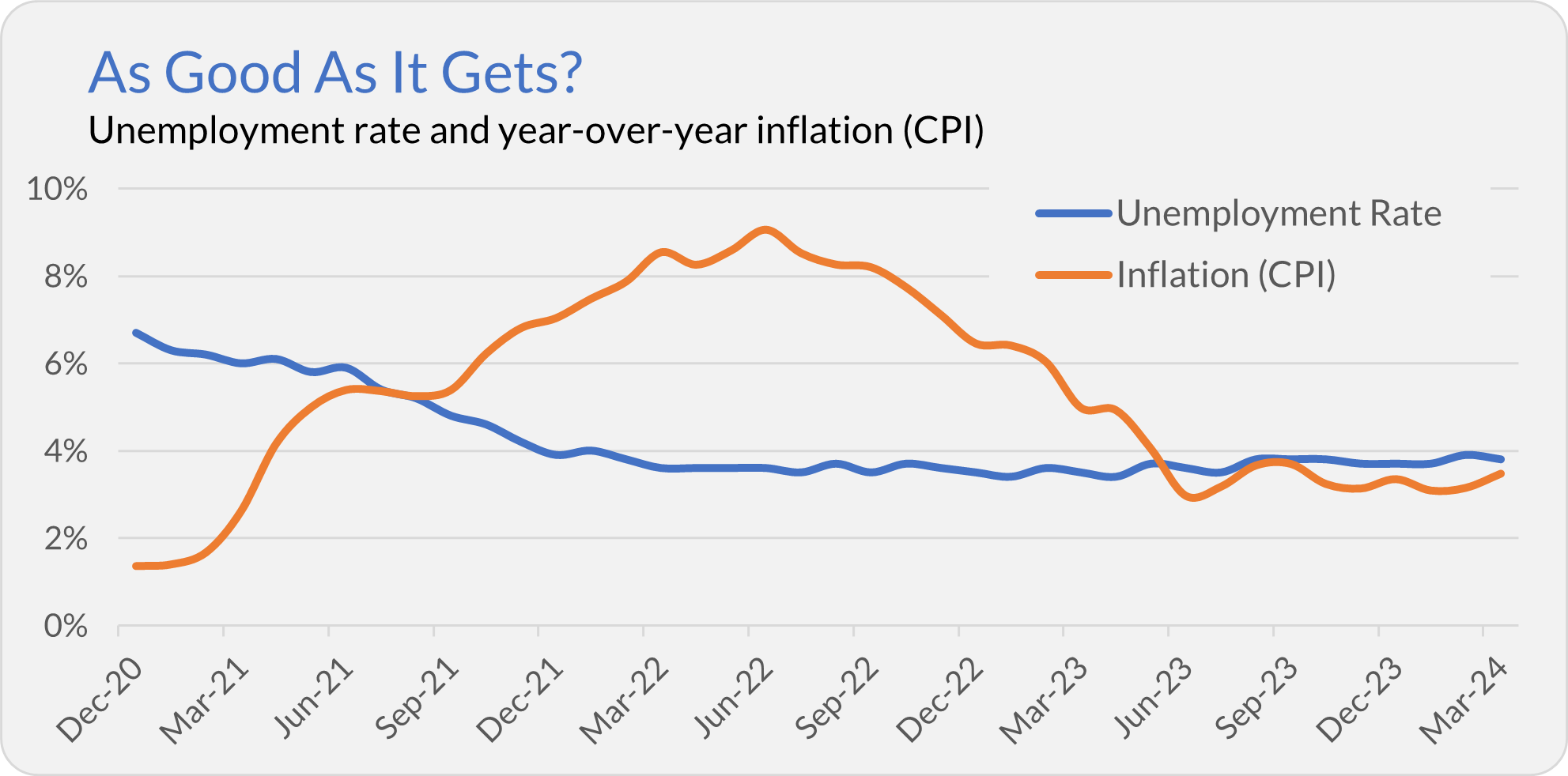

One “big” economic number held steady in March, while another ticked higher: The unemployment rate clocked in at 3.8%, while the consumer price index (CPI, so-called headline inflation) jumped from 3.2% to 3.5%.

A month ago, I asked if this was “as good as it gets” for the economy. I believe the answer is “yes.” But that doesn’t mean a crushing recession is around the corner; it’s just that we’re operating in an almost ideal environment when the economy is growing, Americans are employed, and inflation has moderated. High times, indeed.

Can AI Predict Inflation?

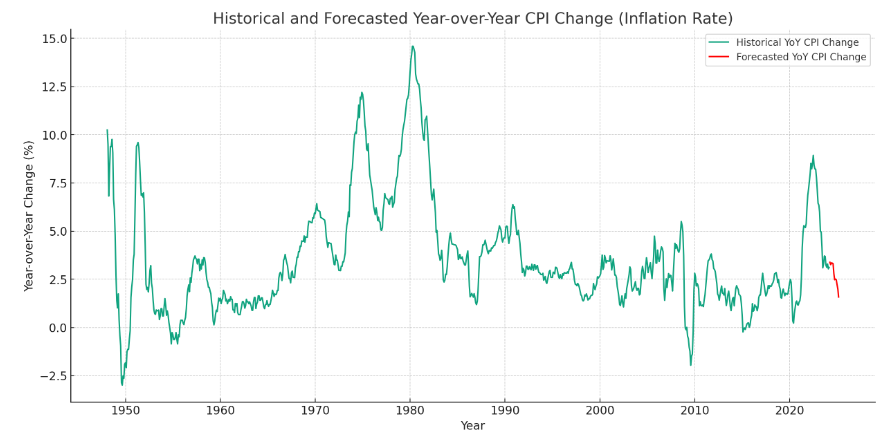

Over the weekend, I fed a load of economic data into ChatGPT’s Data Analyst feature and asked it to predict inflation for the next 12 months. From all the data I uploaded, the computer picked out the consumer price index (CPI) data series and ran through some advanced calculations to come up with a forecast. Below is precisely what the computer said it was doing:

Now that we have the cleaned and structured CPI data, we can proceed with the inflation forecast for the next 12 months. We will use time-series forecasting methods, such as ARIMA (AutoRegressive Integrated Moving Average) or similar models, to predict future inflation rates based on this historical data.

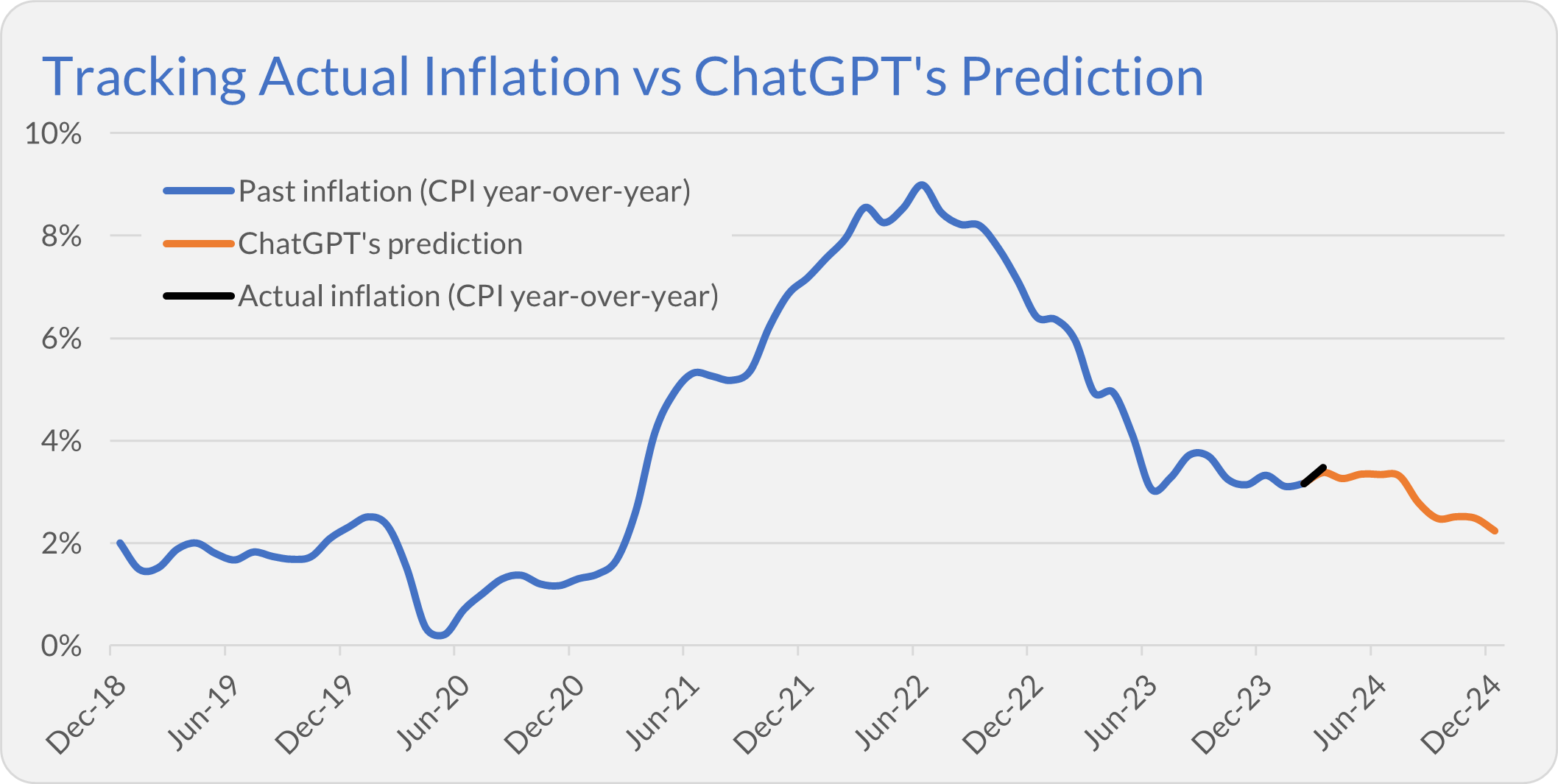

The “Data Analyst” even created a half-decent-looking chart combining past inflation with its forecast upon request.

I was impressed. This only took a few minutes, and I’m still learning to use the tool.

If the computer is to be believed, inflation will fall to 2.2% by the end of the year. While Federal Reserve policymakers would like to see this forecast come to fruition, I don’t expect the computer’s forecast to be correct. Or, if it is accurate, I’d chalk it up to luck. As fancy as an “AutoRegressive Integrated Moving Average” sounds, if predicting inflation was that “easy,” well, the Ph.D.s at the Fed would’ve cracked the code already.

Said differently, I wouldn’t be making trades in my portfolio based on this forecast. But I will have fun comparing ChatGPT’s prediction against actual inflation as it is reported.

The computer is off to a decent start, as its 3.4% prediction for March wasn’t far off the actual 3.5% number.

To be clear, on one level, I’m just having a bit of “fun” with the inflation data here. On a more serious note, generative AI (like ChatGPT) is a force to be reckoned with. It’s also a tool—one I’m spending time learning how to leverage and use.

Data Gets Updated

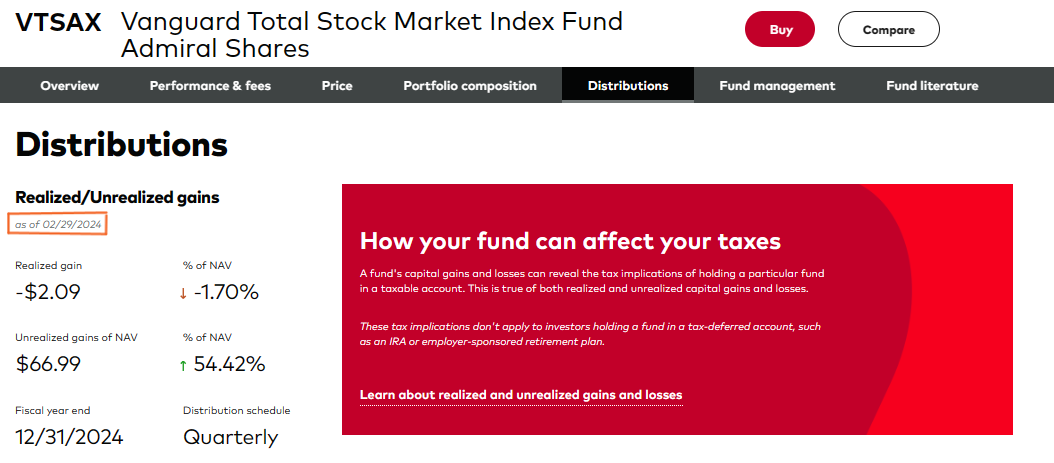

As a quick follow-up to last week’s brief, Vanguard must be reading The Independent Vanguard Adviser because they updated the realized and unrealized capital gains data as of the end of February.

I’m pleased to report that Vanguard is continuing to provide this information to shareholders. As I’ve said, I’d like to see other fund companies follow Vanguard’s lead. Hopefully, Vanguard will update the March numbers in a more timely fashion.

Our Portfolios

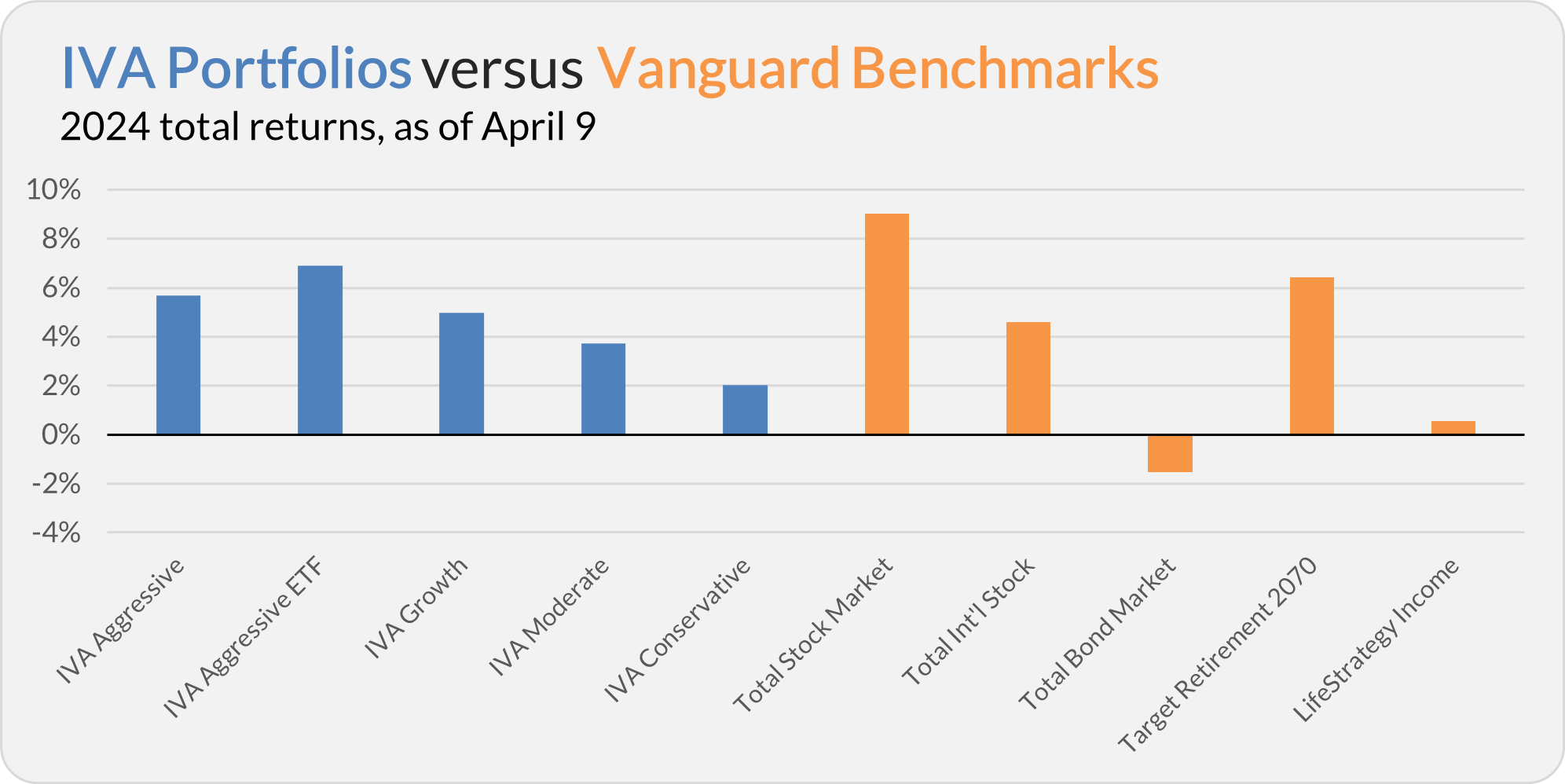

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 5.7%, the Aggressive ETF Portfolio is up 6.9%, the Growth Portfolio is up 5.0%, the Moderate Portfolio is up 3.7% and the Conservative Portfolio is up 2.0%.

This compares to a 9.0% return for Total Stock Market Index (VTSAX), a 4.6% gain for Total International Stock Index (VTIAX), and a 1.5% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 6.4% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 0.5%.

IVA Research

Yesterday, in Misleading Costs, I warned Premium Members against using the cost basis reported on their statements to calculate their total returns. Next week, I’ll show Premium Members which Vanguard funds and ETFs have been the most tax-friendly.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.