Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, April 17.

There are no changes recommended for any of our Portfolios.

If you followed the headlines last week, you might suffer from whiplash this week—the storyline has been changing daily. Last Wednesday, stocks sold off due to inflation fears. On Thursday, traders bought stocks on optimism about technology. On Friday, fears of a large-scale Middle East war had traders selling again.

It's hard to keep up, and I haven’t even mentioned Donald Trump's criminal trial, which began on Monday.

I don’t mean to downplay or diminish the importance of any of these events—Iran launching over 300 drones and missiles at Israel is a significant escalation of hostilities. But I won’t go deep on these issues because this is not a geopolitical or political newsletter. You can find analyses (or hot takes) on those topics elsewhere.

What’s relevant for you, me, and other long-term investors is that market narratives change, sometimes hourly. What seems to matter one day can become less critical or even ignored the next. In the long run, making money in the stock market is about companies' ability to grow earnings over time.

On this score, companies in the S&P 500 index (and beyond) have begun reporting earnings from the first quarter. Lipper expects earnings to be up about 6% year over year (once you’ve adjusted for Bristol Myers Squibb’s one-time charge). Factset expects earnings to be 7% higher than a year ago when all is said and done.

Only a handful of companies have reported earnings, but the early signs are encouraging.

Changing Narrative

Speaking of changing narratives, here’s one that’s bedeviled investors recently: Are higher interest rates good or bad for growth stocks?

How you answer that question depends on which year you are living in.

In 2022, higher interest rates were categorically bad for growth stocks. With inflation running hot, the yield on the 10-year Treasury bond more than doubled—from 1.51% to 3.88%. Growth Index (VIGAX) took it on the chin, tumbling 33.1% during the year. Value Index (VVIAX) only fell 2.1% by contrast.

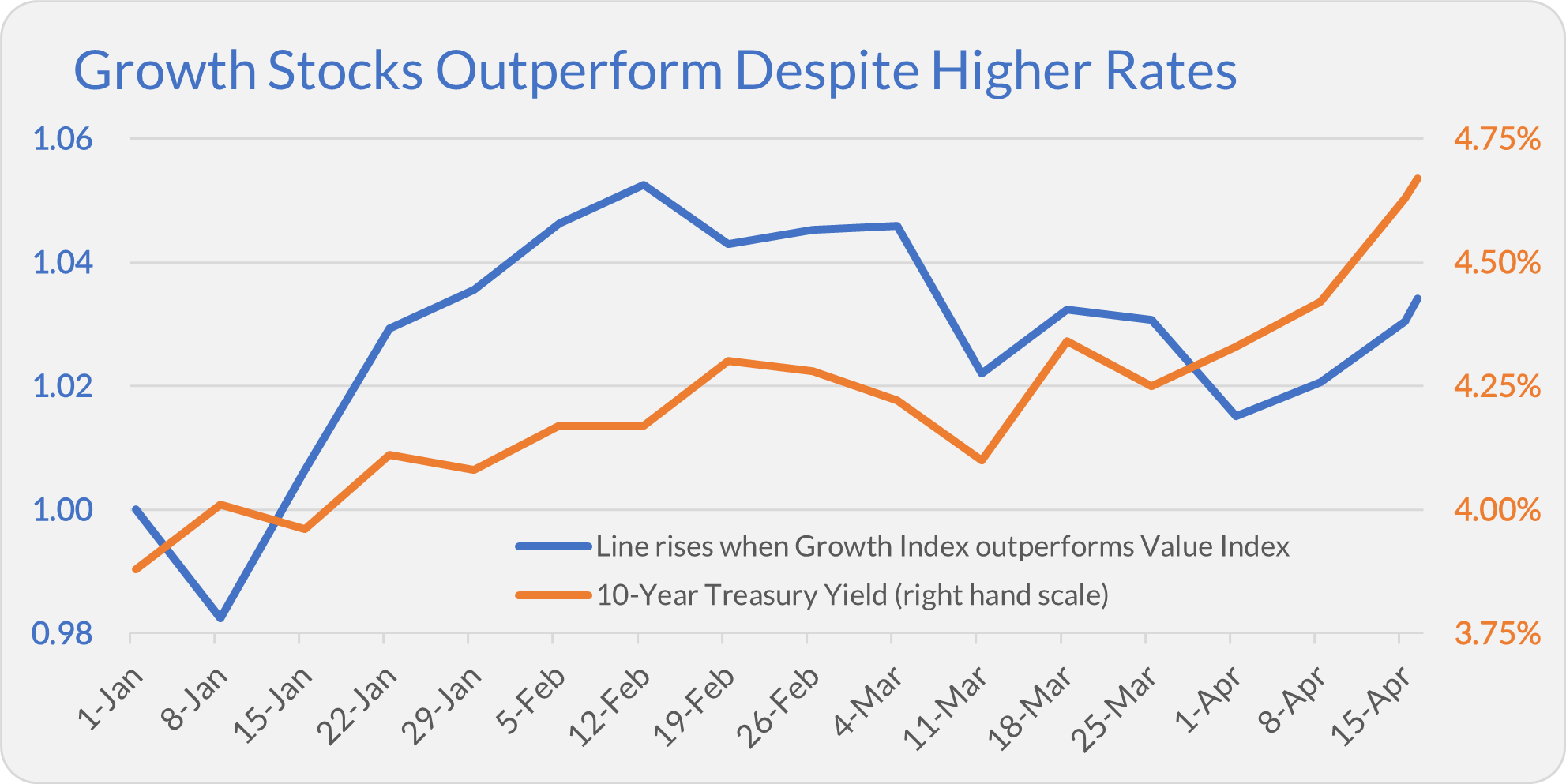

The opposite has played out in 2024. While the yield on the 10-year Treasury has risen from 3.88% to 4.67%, Growth Index has outperformed Value Index, 7.8% to 4.3%.

If you prefer to go month-by-month, March was the only month in which the 10-year Treasury’s yield fell (from 4.25% to 4.20%). It’s also the only month Value Index outpaced Growth Index.

You can see this pattern in the relative performance chart below. The blue line tracks the relative performance of Growth Index and Value Index—it rises when growth stocks outperform. The orange line is the yield on the 10-year Treasury.

I’m using weekly data to remove the daily noise from the picture, but as you can see, Growth Index generally led when interest rates were on the rise.

The old logic was that higher interest rates meant the future earnings of highly-priced growth stocks were worth less in today’s dollars. But that doesn’t seem to have played out recently.

What, if anything, should investors do with this? Probably nothing.

If you think you have an edge in forecasting interest rates—I certainly don’t—there are better (more profitable) ways to apply that edge than trading growth stocks against value stocks. Not only would you have to predict which way interest rates are headed, but you would also have to determine how investors en masse would interpret those moves. Better, in my view, to spend time in the market rather than trying to time the market. (Sound familiar?)

More Executive Changes

The C-suite is looking to get a bit roomier at Vanguard these days.

Last week, IBM announced that Anne Robinson, Vanguard’s general counsel, would become the tech giant’s chief legal officer.

This means that Vanguard will have a new CEO and general counsel within the calendar year … we just don’t know who they will be.

Vanguard didn’t release a statement about Robinson’s departure, though they did say that “a comprehensive search is well underway” for the eight-year veteran’s replacement. With Robinson set to join IBM on July 1, I hope the search is near completion!

So, Vanguard’s top two seats (CEO and Chairman) and the top legal seat are currently “to be determined.” It’s not a good look and leaves me asking, “Who’s next?”

Is Anyone There?

To ask a slightly different question: What’s next?

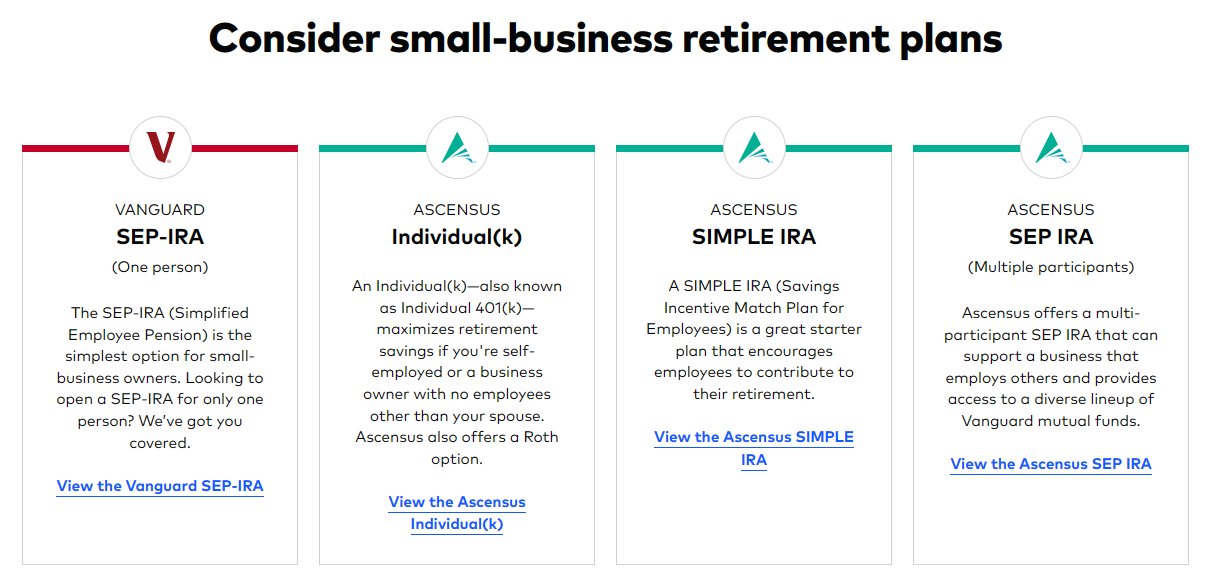

Ascensus, the large financial services and recordkeeping company, announced it was acquiring Vanguard’s small-business retirement plans—think individual 401(k), multiple-participant SEP and SIMPLE IRAs.

If you own one of these plans, you’ll still be able to access Vanguard’s mutual funds through Ascensus’ platform. However, Ascensus is taking over “everything else”—recordkeeping, client service, transaction processing, tax reporting, etc. Ascensus is not buying Vanguard’s large corporate-plan business or other retirement solutions.

I haven’t heard a word from Vanguard on this. And I don’t say that just as a “member of the media” but as an individual 401(k) owner at Vanguard! You’d think Vanguard would communicate with owners of these accounts about upcoming changes. Those changes may already be in motion if Vanguard’s small business page is any indication:

For now, I’m in wait-and-see mode. Vanguard’s individual 401(k) is limited in some ways, but it is easy enough, and having the accounts tied in with my personal Vanguard login is convenient. (Granted, I had a separate login to access the “employer” side of the plan.)

What does this mean for Vanguard?

It is another example of Vanguard shedding “non-core” business activities. Last year, Vanguard exited China, closed a business in Germany, ended its partnership with Amex and sold its Vanguard Institutional Advisory Services—an OCIO (outsourced chief investment officer) service supporting pensions and endowments.

Vanguard’s technology and service woes have been well documented. One way Vanguard can try to improve its tech and service is to simply do fewer things. This would let Vanguard focus its resources more effectively—at least, that’s my hope.

Bye-bye Bitcoin

I’ve discussed my speculative bitcoin position several times this year, and I certainly don’t intend to spend much time discussing my bitcoin trading strategy. Still, in the spirit of transparency (and because some of you may be curious), I exited my bitcoin position on Friday.

Why? Two reasons: First, its upward momentum had stalled. Second, with Iran telegraphing a strike on Israel, I wanted to exit this “low conviction” holding. Despite its reputation as digital gold, bitcoin hasn’t been a safe haven. Since my sale at $67,000 (or so), the cryptocurrency has fallen by about 9%. So, I won that one.

Will I speculate on bitcoin again? Probably.

Even having a small position during the recent rally helped manage my FOMO (fear of missing out). Plus, I made good money on the trade … I probably wouldn’t try again if it had gone the other way! (That’s not exactly a “good” reason, but I’m trying to be honest with myself and you.)

Our Portfolios

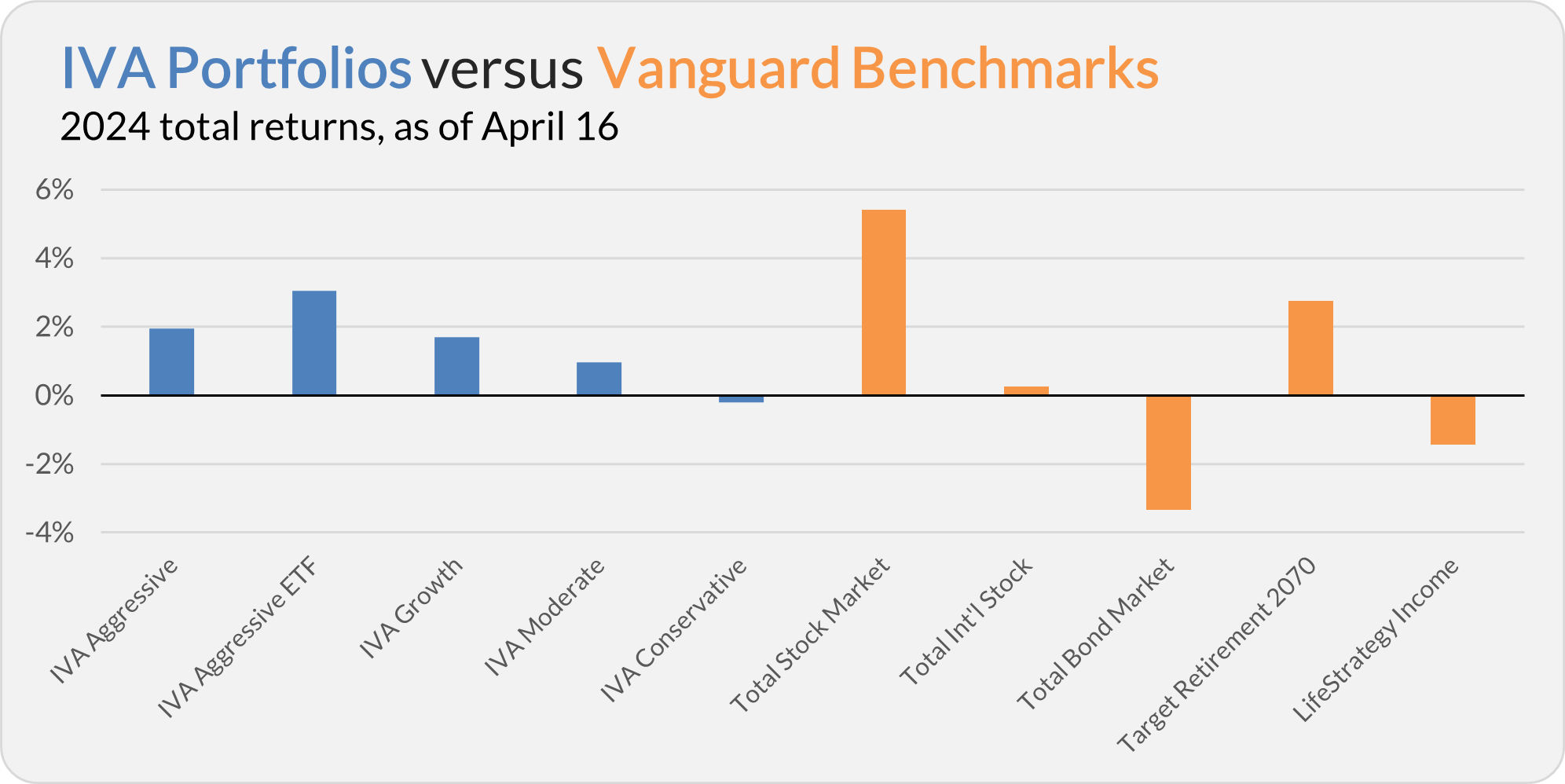

Our Portfolios are showing modest returns for the year through Tuesday. The Aggressive Portfolio is up 2.0%, the Aggressive ETF Portfolio is up 3.1%, the Growth Portfolio is up 1.7%, the Moderate Portfolio is up 1.0% and the Conservative Portfolio is down 0.3%.

This compares to a 5.4% gain for Total Stock Market Index (VTSAX), a 0.3% return for Total International Stock Index (VTIAX), and a 3.3% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 2.7% for the year, and its most conservative, LifeStrategy Income (VASIX), is down 1.4%.

IVA Research

Yesterday, in Taxing Returns: 2024, I showed Premium Members which Vanguard funds and ETFs were the most tax-efficient.

Next week, I plan to publish two educational articles about ETFs. While that may seem like a slight detour from the tax conversation, the articles set the stage for comparing Vanguard’s ETFs and index mutual funds … Stay tuned.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.