Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, May 8.

There are no changes recommended for any of our Portfolios.

Here’s your latest reminder that trading is hard: Commodity Strategy (VCMDX) was Vanguard’s best-performing fund in April with a 2.5% gain. The tables have turned in May. As of Tuesday, the commodity fund is Vanguard’s worst-performing fund, down 1.7%.

This month, the only other Vanguard fund in the red is Energy ETF (VDE), down just 0.1%.

For another reminder, look at the bond market. Total Bond Market Index’s (VBTLX) 2.4% decline was the fund’s 12th-worst month since its 1986 inception. In the first five trading days of May, the bond index fund gained 1.6%. Talk about whiplash… if you’re a trader.

Mailbag: Are Bonds Dead?

Speaking of bonds, an IVA reader recently asked for my opinion on this article. The article quotes a recent missive from Bill Gross, the former “bond king” portfolio manager of PIMCO Total Return: They Just Wanna Sell You a Bond Fund. Gross’s final comment, in particular, caught the eye:

“Total Return [the fund] is dead. Don’t let them sell you a bond fund.”

Pretty dramatic. So, what’s my opinion?

Bill Gross has been trading bonds for decades—longer than I have been alive. So, while he is a legend in the industry, he’s also been known to get it wrong at times—I think he’s got it wrong again.

PIMCO Total Return, for those unfamiliar with it, is your classic “intermediate-term” bond fund holding a mix of high-quality Treasurys, mortgage-backed securities, and corporate bonds. Core Bond (VCORX) is probably the closest fund in Vanguard’s lineup to the PIMCO fund. However, I also count Total Bond Market Index (VBMFX), Intermediate-Term Investment-Grade (VFICX) and others in the “Total Return” act-alike contest.

To be clear, I do not think these funds are anywhere close to dead.

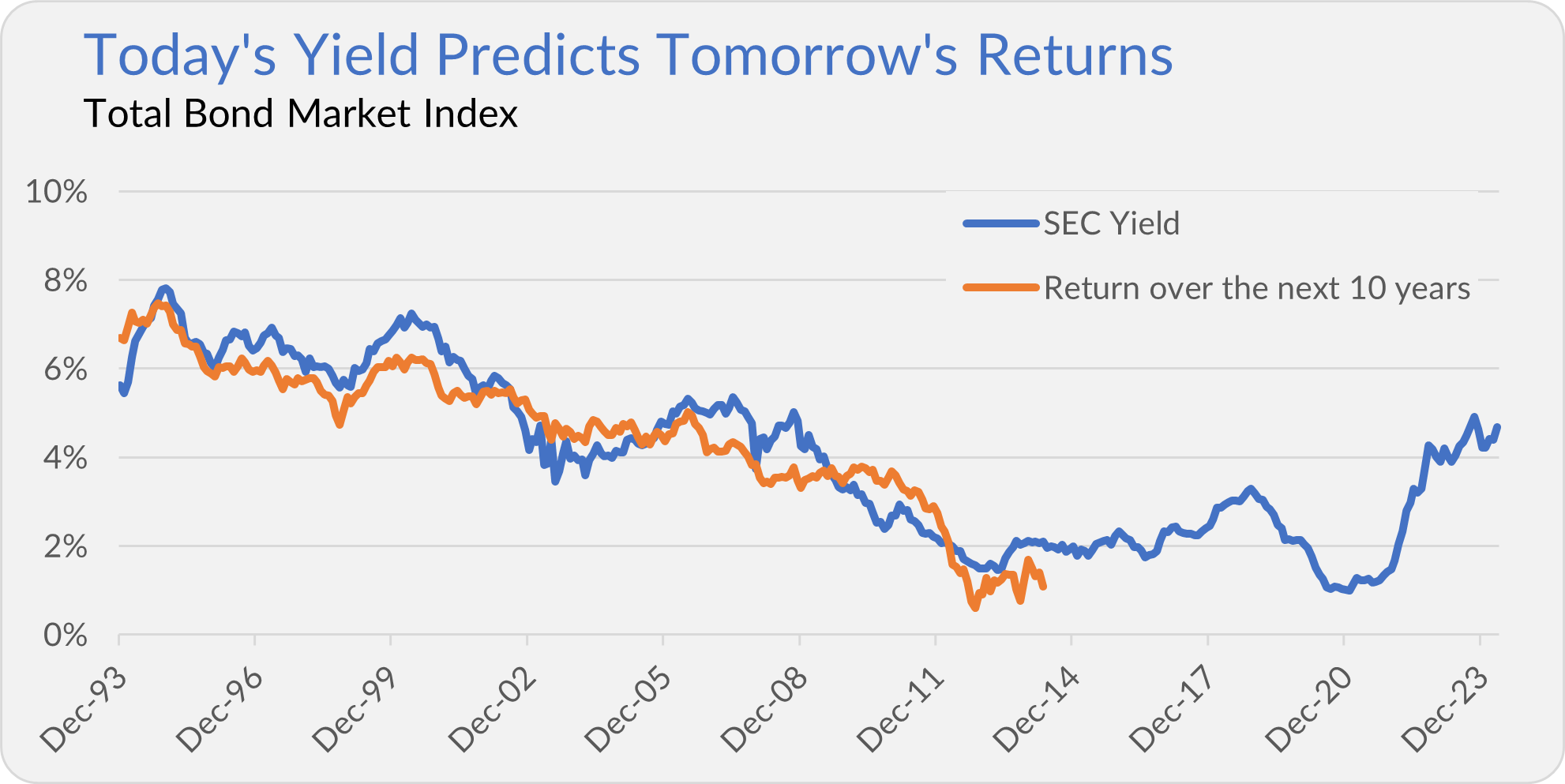

As I’ve shown many times before, a bond fund’s starting yield is a good indicator of its future returns. The following chart shows how Total Bond Market Index’s SEC yield and subsequent 10-year annualized return closely track each other. The chart suggests that buying Total Bond Market Index today sets you up for a 4.7% (or so) annualized return over the next decade—better than you could have earned over the past 15 years.

To be clear, I’m not trying to sell you a bond fund. I also don’t consider myself particularly bullish on bonds as wealth builders—talk to me if Treasury yields ever approach double digits again.

My point is that the time to declare total return bond funds dead was in 2020, when Total Bond Market Index was yielding 1% or so, and bonds were about to enter a massive bear market.

As noted, today’s yields suggest that Total Bond Market Index will return around 4% to 5% (per year) over the next decade. I’m not jumping at the chance to earn those returns. But, if earning that type of return on an asset that has historically protected against stock market declines makes sense for your portfolio, well, that’s what’s on offer in the bond market right now.

And yes, you can earn 5% on cash today. I’ve warmed to the idea of holding cash in an investment portfolio, but I also don’t have the same conviction that cash will continue to earn 5% over the next ten years as I do with bond funds. In fact, if the Federal Reserve begins to cut interest rates before year-end, those 5% money market yields will end.

Of course, as I’ve said before, it doesn’t have to be all or nothing—you can own both money market funds and bond funds! In my Portfolios, I recommend a mix of short-term and intermediate-term bond funds.

Please, Don’t Call Us

Vanguard wants investors to pay more, and at the same time, they’re giving us less. Just as we were learning that fees were on the rise, Vanguard’s technology was frustrating shareholders yet again. On May 1—the same day the new fee schedule was released—several IVA readers told me they could not access their holdings data at Vanguard. Oops!

Also, Vanguard would prefer that we call less often.

The Amendment to the Vanguard Brokerage Account Agreement includes a new “Digital Interaction Expectations” section. What are those expectations?

Vanguard expects us to provide our emails and mobile phone numbers and primarily use digital channels when interacting with Vanguard and our accounts (think online, via the mobile app, instant chat, text message and the secure message center). Vanguard calls this a “digital-first service model,” and warns that …

“excessive reliance on Our phone associates for tasks that can be accomplished online may negatively impact Your customer service experience, including but not limited to delayed response times, additional fees, and possible Account termination.”

Yikes! Delayed response times are nothing new at Vanguard. But if you call too many times, Vanguard might close your account. That sounds very un-Vanguard-like.

It’s unclear what counts as “excessive reliance” on the phones. However, like the $25 fee to trade over the phone, this move to digital-first service puts seniors uncomfortable with the internet second.

Misclassification

Speaking of Vanguard tech issues, I’d like to share a problem one of your fellow IVA readers recently ran into. When he converted an IRA into a Roth IRA, Vanguard classified the transaction as his required minimum distribution (RMD). That’s a no-no. A conversion to a Roth IRA does not count toward satisfying your RMD.

When the investor told the Vanguard representative, he said he would “pass on this information.” Not the most satisfying response or solution, I’d say. If you find yourself converting a traditional IRA into a Roth IRA, well, you’ve been warned.

Let’s hope that Vanguard puts the additional revenue from its new fees to good use in solving its service issues.

Our Portfolios

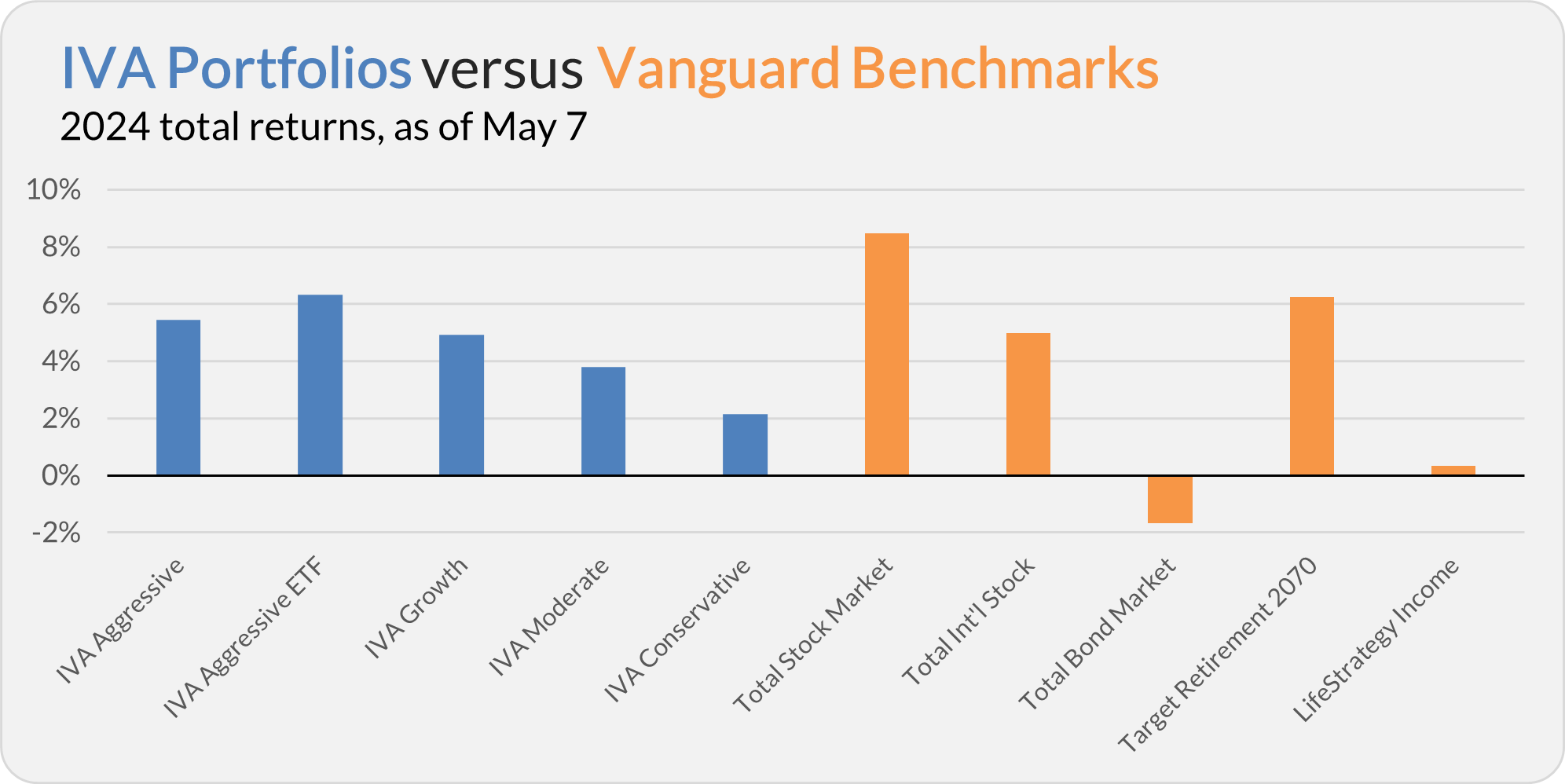

Our Portfolios are showing decent absolute returns for the year through Tuesday. The Aggressive Portfolio is up 5.5%, the Aggressive ETF Portfolio is up 6.3%, the Growth Portfolio is up 4.9%, the Moderate Portfolio is up 3.8% and the Conservative Portfolio is up 2.1%.

This compares to an 8.5% gain for Total Stock Market Index (VTSAX), a 5.0% return for Total International Stock Index (VTIAX), and a 1.7% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 6.2% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 0.3%.

IVA Research

Yesterday, in Finding Vanguard’s Active ETFs, I tried to answer two questions for Premium Members: First, Why has Vanguard only dipped a toe in the active ETF waters? Second, how do Vanguards actively manage mutual funds stack up compared to their ETF siblings?

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.