Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, June 26.

There are no changes recommended for any of our Portfolios.

A week ago, NVIDIA looked unstoppable as it eclipsed Microsoft and Apple as the largest company on the planet (at least measured by market capitalization). Even though I told you that I didn’t think NVIDIA’s run was sustainable, I didn’t expect the stock to fall 13%—from $135.58 to $118.11—over the next three trading days.

Was $135.58 the peak for NVIDIA’s stock? I’d wager it was not the peak—NVIDIA bounced back 6.8% yesterday. But, even if NVIDIA hits new high after new high, at some point, it’ll reach a peak. And while I’m often the first to caution against reading too much into short periods in the market, I was curious to see which Vanguard funds performed well (and poorly) during NVIDIA’s three-day slide. (Frankly, I wasn’t surprised by the results.)

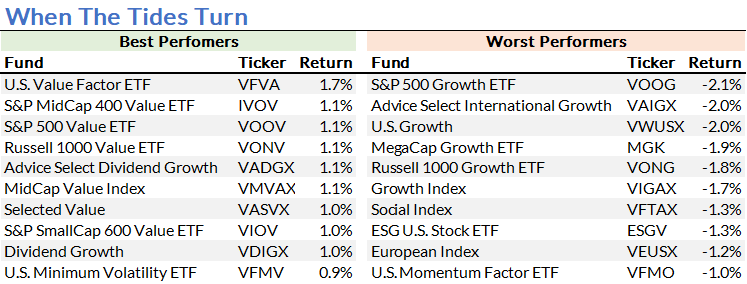

No one will be surprised that Information Technology ETF (VGT)—where NVIDIA accounts for about 15% of the portfolio—was the worst-performing Vanguard fund with a 3.7% decline. But let’s put the sector funds aside for a moment and consider Vanguard’s diversified stock funds. The table below shows Vanguard’s ten best and worst-performing funds.

Vanguard’s value index funds (and ETFs) dominate the best-performer list, though U.S. Value Factor ETF (VFVA) topped the list with a 1.7% gain. Dividend Growth (VDIGX) and its more concentrated Advice Select version (VADGX) also cracked the top 10 with gains of 1.0% and 1.1%, respectively.

On the other end of the spectrum, growth index funds and ETFs, led by S&P 500 Growth ETF (VOOG), were the worst performers. U.S. Growth (VWUSX) nearly topped the list with a 2.0% decline. Social Index (VFTAX) and ESG U.S. Stock ETF (ESGV) also made the bottom 10.

It’s only three trading days, so take this analysis with a grain of salt. But, if you are looking for funds that may carry the day when the tech giants run out of steam, well, the above list is a decent starting place.

Turn Down the Noise

With President Biden and former President Trump set to square off in their first debate tomorrow (Thursday, June 27), the election noise is going to 11. I’ll leave the political commentary to others. As I told you last week, the best advice I can give when it comes to your portfolio is to try turning down the volume.

On Air

If you are looking for something else to listen to, I joined Chuck Jaffe on the Money Life with Chuck Jaffe podcast to discuss Vanguard’s decision to reopen PRIMECAP (VPMCX) and PRIMECAP Core (VPCCX) to new investors.

You can listen to my segment below:

If you prefer, you can read a copy of the transcript below. Please excuse any typos or errors in the transcript. I have been testing different voice-to-text programs. (Also, if you click this link in the email and it doesn't download, try clicking it while on our website.)

Finally, the full June 25, 2024 episode can be found here, at the moneylifeshow.com website or on your favorite podcast streaming service.

Enjoy.

System Down

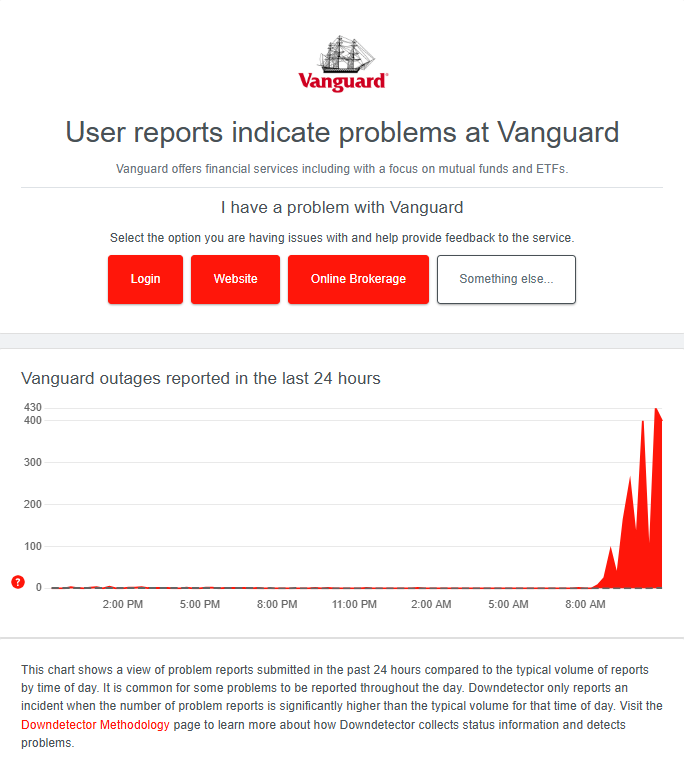

Believe it or not, I eagerly await the day I tell you that Vanguard’s technology and service have turned the corner. That day hasn’t arrived yet.

Judging by my inbox and Downdetector, Vanguard’s website and app stopped functioning on Tuesday morning.

We all make mistakes, but Vanguard’s technology and service snafus have become the firm’s Achilles heel. What’s remarkable is that Vanguard continues to ignore their failings, making statements about their improvements like this:

In recent years, Vanguard has intentionally and strategically invested in modernizing our digital pathways – including our website and the Vanguard mobile app – as part of our commitment to providing a world-class experience for our clients. We encourage our investors to web register and utilize Vanguard digital channels for an efficient, effective, and secure client experience.

Salim Ramji will become Vanguard’s CEO on July 8. I hope he has “fix our technology and service” at the top of his to-do list.

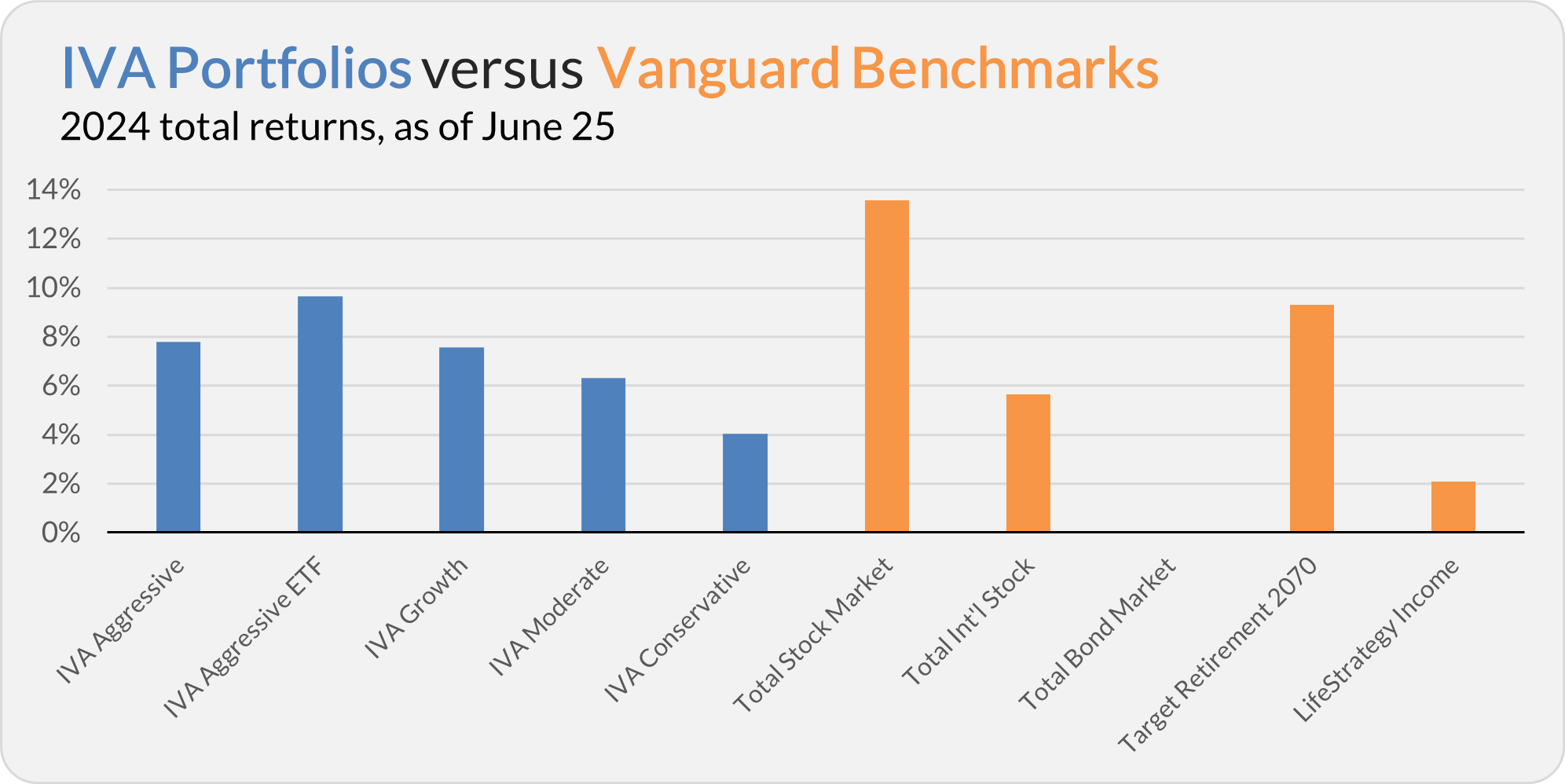

Our Portfolios

Our Portfolios are showing decent absolute, but lagging relative returns for the year through Tuesday. The Aggressive Portfolio is up 7.8%, the Aggressive ETF Portfolio is up 9.6%, the Growth Portfolio is up 7.6%, the Moderate Portfolio is up 6.3% and the Conservative Portfolio is 4.0%.

This compares to a 13.6% gain for Total Stock Market Index (VTSAX), a 5.6% return for Total International Stock Index (VTIAX), and a 0.1% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 9.3% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 2.1%.

IVA Research

Yesterday, I shared my exclusive interview with International Core Stock (VWICX) managers Kenny Abrams, Halsey Morris and Anna Lundén with Premium Members. It was one last chance to speak with Abrams before his retirement. Enjoy.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.